An LC is a contract via a bank that helps guarantee the payment of a supplier as long as the supplier meets the conditions agreed upon in the LC. In an LC, the buyer and seller will enter a sales contract, and the buyer (importer) will apply for a letter of credit with their bank (issuing bank), which will be sent to the supplier’s bank.. As for letters of credit, they are used by firms that import and export items regularly. 5. Number of parties involved. A letter of credit involves five or more parties, such as the buyer, seller, providing bank, consulting bank, negotiating bank, and validating bank. A bank guarantee involves only three parties: buyers, sellers, and lenders. 6.

Letter of Credit vs Bank Guarantee Difference and Comparison

Letter of Credit vs Bank Guarantee Euro Exim bank

Letter of Credit vs Bank Guarantee Global Logistics Know How

Bank Guarantee Vs Letter Of Credit What is the Difference?, BGs Vs LCs, Examples, Benefits and

Difference Between Bank Guarantee And Letter Of Credit?

letter of credit vs bank guarantee letter of credit bank credit YouTube

Letter of Credit vs. Bank Guarantee — What’s the Difference?

Letter of Credit vs Bank Guarantee Global Logistics Know How

Letter of Credit vs. Bank Guarantee What’s the Difference?

Letter of Credit vs Bank Guarantee Difference and Comparison

Infographic Letter of Credit vs Bank Guarantee in 2023 Trade finance, Lettering, Bank

PPT Different Types of Bank Guarantees And Letter of Credit PowerPoint Presentation ID7557397

Diferencia entre carta de crédito y garantía bancaria Marketing e Influencer

Bank Guarantee What is it? Example, Feature, Types, Limit & Importance

Letter of Credit vs Bank Guarantee Difference and Comparison

Letters of Credit (LCs) versus Bank Guarantees (BGs) 2022 FREE TFG Guide

This infographic is published by Bronze Wing Trading L.L.C., the trade finance provider in Dubai

A standby letter of credit (SBLC) vs Bank guarantee (BG) Detail Explanation CFAJournal

Difference between Letter of Credit and Bank Guarantee ThesisBusiness

:max_bytes(150000):strip_icc()/difference-between-bank-guarantee-and-letter-of-credit-final-2824492ac4f3481490982697b3e4a59d.jpg)

Bank Guarantee vs. Letter of Credit What’s the Difference?

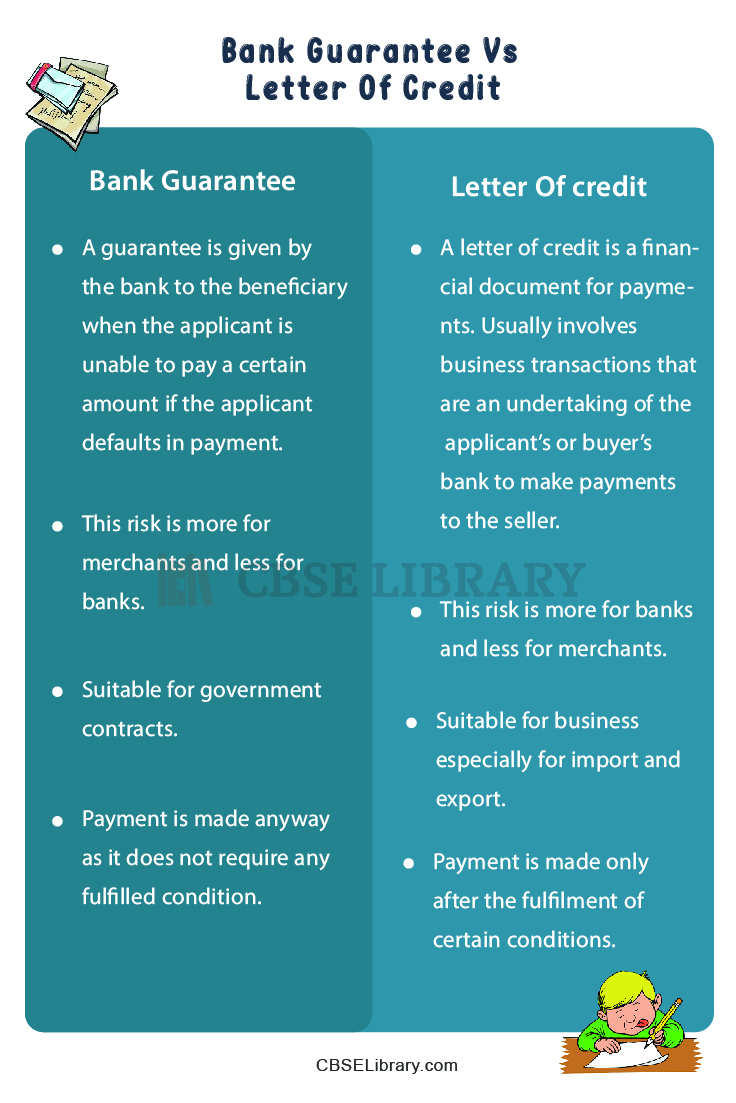

Key Takeaways. A letter of credit is a financial instrument that guarantees payment to a seller when certain conditions are met. In contrast, a bank guarantee is a promise by a bank to cover a loss if a borrower defaults on a loan or fails to fulfill contractual obligations. Letters of credit are commonly used in international trade to mitigate.. In a letter of credit, the payment is made by the bank, as it becomes due, such that it does not wait for applicant’s default and beneficiary to invoke undertaking. Conversely, a bank guarantee becomes effective, when the applicant defaults in making payment to the beneficiary. A letter of credit ensures that the amount will be paid as long.