It is normally between £1000-£1500. Supervisor fees are the amounts deducted from your payments each year to pay for the ongoing management of your IVA. These normally equal around 15% of the money you pay in every 12 months. Your IVA company will agree all the fees they plan to deduct up front with your creditors.. In particular increases in your electricity, gas and fuel bills. Your IVA company may not agree to all of your cost of living increase claims. They may, for example, reject an increase in your housekeeping budget. After a pay rise they will expect your monthly payments to go up by at least something. If you earn extra overtime during an IVA.

Allowable Living Expenses in an IVA Beat My Debt

Cancel my IVA and pay the debts myself Beat My Debt

IVA if Living with Parents Beat My Debt

Download Living Expenses Guide IVA Information

What if my goes up during a debt management plan Beat My Debt

IVA equity release rules 2023 guide IVA Information

Stop IVA and start a debt management plan IVA Information

How to get a Mortgage after your IVA Beat My Debt

IVA Spending Restrictions 2023 Guide IVA Information

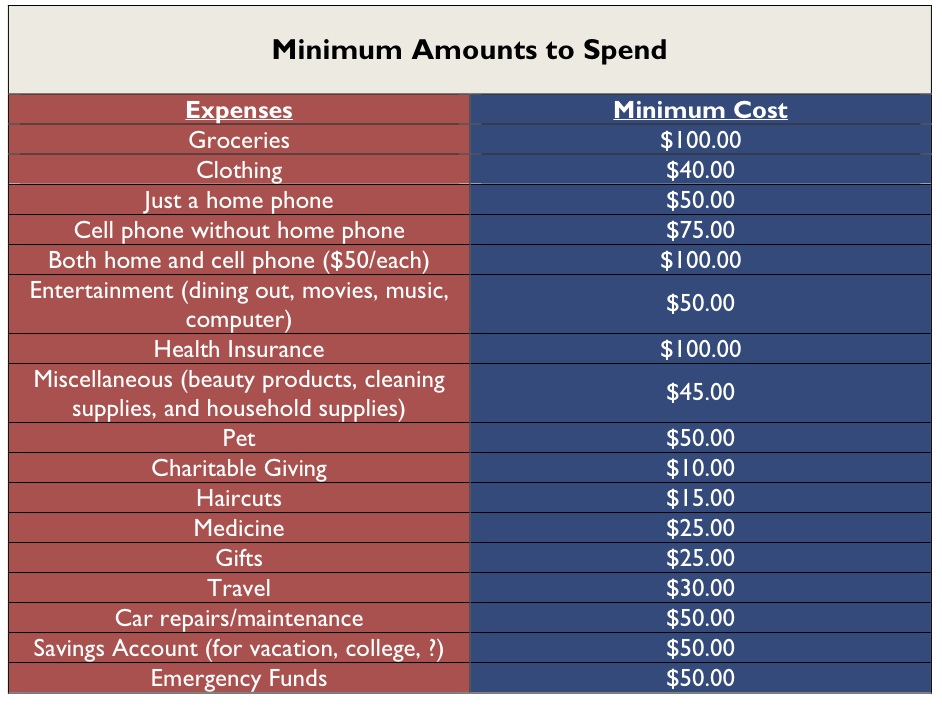

Additional Living Expenses Worksheet Preschool Printable Sheet

What happens to my Pension in an IVA Beat My Debt

Can pet expenses can be included in an IVA IVA Information

IVA The Ultimate Guide IVA Information

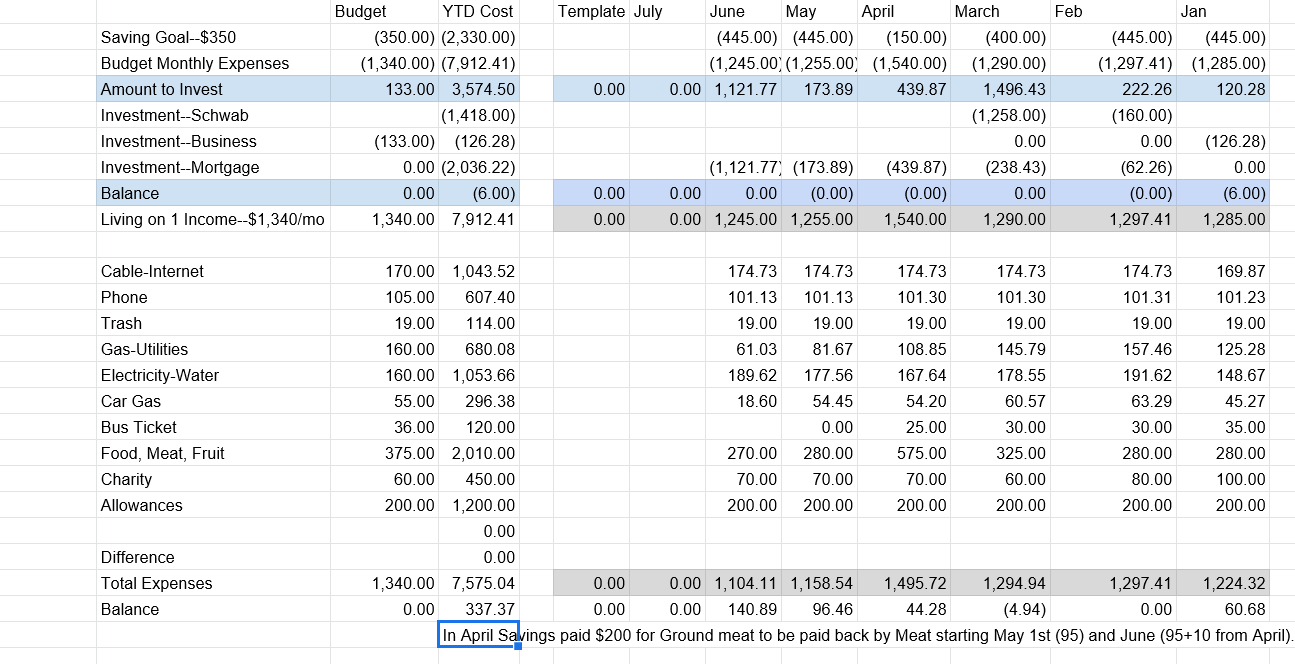

How to Budget your Living Expenses Nina’s Soap

IVA Living Expenses Guide Write off Unaffordable Debt IVA Information

IVA A Beginner’s Guide Beat My Debt

Cost of living pay rise during an IVA IVA Information

Which debts can you leave out of an IVA IVA Information

Can I get a mortgage if I pay off my IVA early IVA Information

Can you stop a debt management plan and start an IVA IVA Information

2023 Allowable Living Expenses Health Care Standards Out of Pocket Costs Under 65 $79. 65 and Older $154 SB/SE – Research – Team #1 Page 1 of 1 April 24, 2023: Title: 2023 Allowable Living Expenses Health Care Standards Author. Created Date: 4/11/2023 7:08:30 AM.. If you are having difficulty, Insolvency Service guidance issued in June 2022 means your IVA company could now be able to help by reducing your payment by up to 50% or £75, whichever is higher. Before any reduction is allowed, you will have to carry out a full income and expenses review. You will need to prove how much your expenses have.