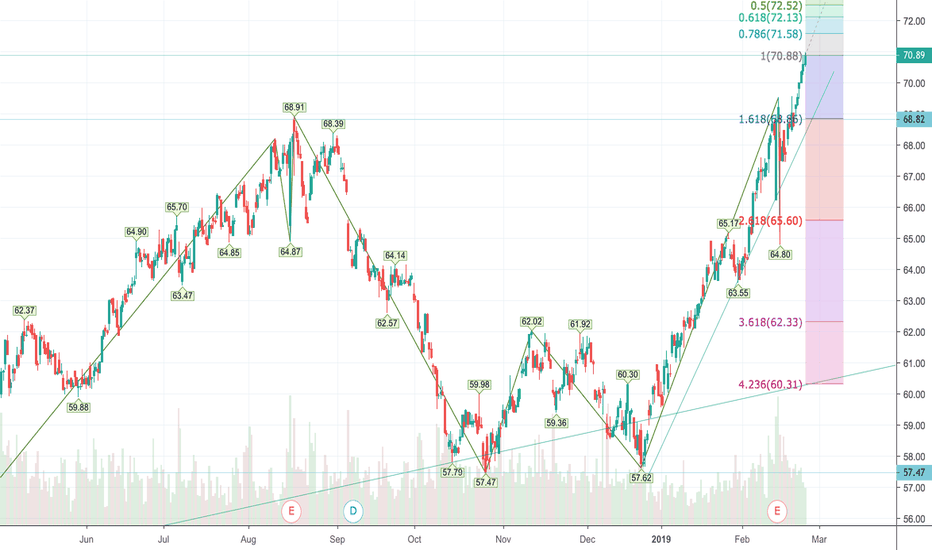

On Wednesday, Bega Cheese Ltd (BGA:ASX) closed at 4.42, -2.43% below its 52-week high of 4.53, set on May 06, 2024. Data delayed at least 20 minutes, as of May 08 2024 07:10 BST. All markets data located on FT.com is subject to the FT Terms & Conditions. All content on FT.com is for your general information and use only and is not intended to.. Get the latest Bega Cheese Ltd (BGA) real-time quote, historical performance, charts, and other financial information to help you make more informed trading and investment decisions.

ASX Stock Price and Chart — ASXASX — TradingView

Asx 200 List Download Jackie Hale

ASX Back in the Green? — The ASX 200 Stocks to Watch Now

Bhp Asx Price Forecast

Sydney Airport Share Price Asx Today JulianMeeson

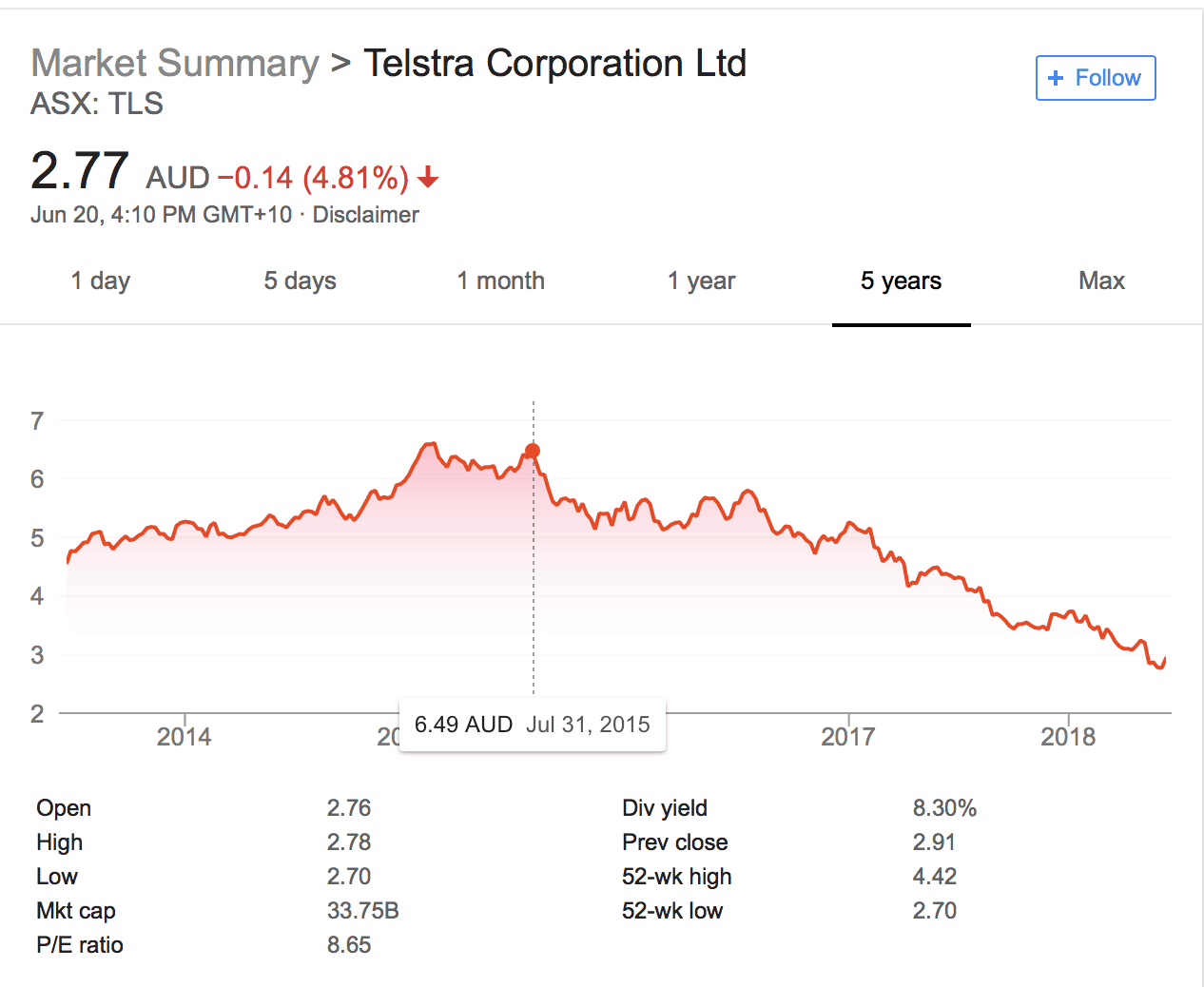

The Telstra (ASXTLS) share price is down nearly 60 in 3 years

BGA provides trading update and FY2022 outlook update Latest ASX News ASX Listed Companies

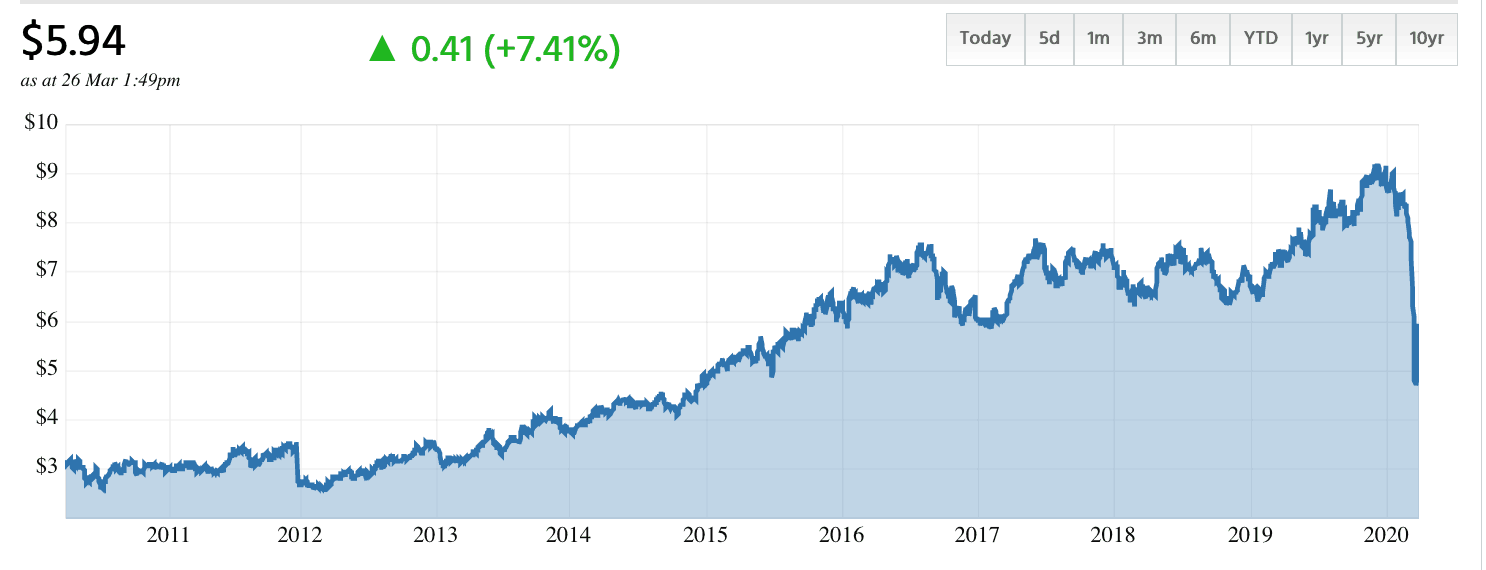

Why did the CSL (ASXCSL) share price go backwards in February?

ASX Stock Price and Chart — ASXASX — TradingView

BGA Stock Price and Chart — ASXBGA — TradingView

BGA Stock Price and Chart — ASXBGA — TradingView

BGA Stock Price and Chart — ASXBGA — TradingView

5 ASX 200 shares smart investors are buying right now

Is the Bega (ASXBGA) share price a buy after its Lion Dairy acquisition? Rask Media

ASX stock Analysis BGA TradeSetup

BGA Stock Price and Chart — ASXBGA — TradingView

Why is the Bega Cheese (ASXBGA) share price jumping today?

Why has the Transurban (ASXTCL) share price tumbled 12 so far in 2022?

ASX Stock Price and Chart — ASXASX — TradingView

ASX 200 today Evolution & Z1P shares taken to the cleaners Rask Media

Per-Share Earnings, Actuals and Estimates. View the latest Bega Cheese Ltd. (BGA) stock price, news, historical charts, analyst ratings and financial information from WSJ.. Dividend Yield explained. Implied Growth. 39.3%. 27.2%. Industry Avg. BGA. ATTRACTIVE : Bega Cheese exhibits an implied growth ratio which is less than the industry average for food beverage & tobacco stocks listed on the ASX. BGA calculation: 10% – (-$0.69 / $4.05) = 27.0% Implied Growth explained. Price / Book.